36+ Calculate consolidation loan payment

Lets calculate your costs if you have a 20000 loan with a 6 percent APR and a repayment term of 10 years. Many borrowers frequently take conforming conventional loans with 15 or 30-year fixed-rate terms.

Free 36 Resignation Letters Samples Templates In Pdf In 2022 Resignation Letters Resignation Letter Sample Resignation

Rates starting at 645 APR 1 with terms up to 7 years.

. The initial payment schedule is set upon receiving final terms and upon confirmation by your school of the loan amount. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter.

1000 to 40000. 3 min read Sep 13 2022. A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans.

For example you could use a personal loan to consolidate. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Less common when auto manufacturers offer low loan rates but when auto rates are higher than equity rates.

See My Options Sign Up. Credit card calculators. A longer term allows buyers to obtain a larger loan amount which they might not afford with a shorter payment term.

Weigh Your Consolidation Options. Repairs additions vehicle purchase. The Annual Percentage Rate APR shown is for a personal loan of at least 10000 with a 3-year term and includes a relationship discount of 025 Your actual APR may be higher than the rate shown.

Mortgage insurance typically costs 05 185 percent of your loan amount per year billed monthly though it can go higher or lower depending on your credit score down payment and length of your loan. Conventional Loan Terms and Payment Structure. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular payments.

The monthly payment on these types of loans is also fixed and the loan is paid over time in equal installments. Your monthly consolidation payment must fit your budget. You will only need to pay for mortgage insurance if you make a down payment of less than 20 of the homes value.

Coffee shop employee jumps for joy as he receives first paycheck. They can even be a tool for building credit if you. Personal loans can offer an alternative to credit cards by giving you a predictable and fixed repayment plan.

A debt consolidation loan is a type of unsecured personal loan that you can use to pay off multiple kinds of debt leaving you with just one loan and payment to manage. Fixed low rates and payments. Debt Consolidation Calculator How much can.

830 to 36. No loan origination fees. This will require a little research as there are a few options to choose from.

Credit Card Comparison Calculator Use Our Credit Card Comparison Calculator To Calculate Total Costs and Rate Changes with up to 3 Credit Cards. Consolidating high-interest credit card balances other debts home improvement. No prepayment penalties or finance charge refund for early payment.

You can use the following calculators to compare 15 year mortgages side-by-side against 10-year 20-year and 30-year options. You could borrow 10000 over 48 months with 48 monthly repayments of 22936Representative 49 APR annual interest rate fixed 479. Credit cards.

A car payment of 300 a. Lending activities can be directly performed by the bank or indirectly through capital markets. Calculate If Debt Consolidation Is Right for You.

Get 247 customer support help when you place a homework help service order with us. Federal government websites often end in gov or mil. Personal loans are installment loans with fixed interest rates that you can use for a variety of reasons.

For each Direct Loan that a school disburses to a student or parent the school must submit a loan award record to the Common Origination and Disbursement COD system that includes the students grade level the loan period and academic year dates the loan amount the anticipated and actual dates and amounts of the loan disbursements and. If you go with a debt consolidation loan paying off all those debts with a new loan. The gov means its official.

2 If approved youll borrow a set amount of money and pay it off with monthly payments over a scheduled period of time. The new Upgrade Cash Rewards Elite Visa combines features of both a personal loan and traditional credit card and also offers rewards on purchases. Common Home Equity Loan Uses.

The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. Some of the most common uses are. Personal lines of credit.

You may repay this loan at any time by paying an effective APR of 23. A smart loan option for expenses like medical bills home repairs education costs debt consolidation and any other large purchase. This calculator shows how a Wells Fargo Personal Loan may benefit you if you consolidate your existing debts into a single fixed rate loan.

Credit Card Calculator Calculate the total cost of a credit card based upon the balance and the minimum payment made. However how the lender applies the payments youre making to the loan balance. Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford.

Calculate how much money you need to borrow to consolidate all of your debts. Homeowners tap home equity for a wide variety of reasons. Before sharing sensitive information make sure youre on a federal government site.

The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. Taking out a personal loan to streamline your payments and increase the. This representative APR Representative APR The representative APR is the rate that at least 51 of people are expected to receive when taking out a loan within the stated amount and term range.

Followed by one final payment of 137 for a total of 20610 paid over the life of the loan. Because banks play an important role in financial stability and the economy of a country most jurisdictions exercise a high degree of regulation. Todays national mortgage rate trends.

In this case you would take the amount you borrowed and multiply it by your interest. Lenders also offer them in 10-year 20-year and 25-year payment terms. Borrow up to 100000.

Fgen 10k 20151231 Htm

Genelux Corp Ipo Investment Prospectus S 1

Presentation Materials

36 Best Birthday Wishes Messages For Employees Birthday Wishes Messages Wishes Messages Best Birthday Wishes Messages

S 1

2

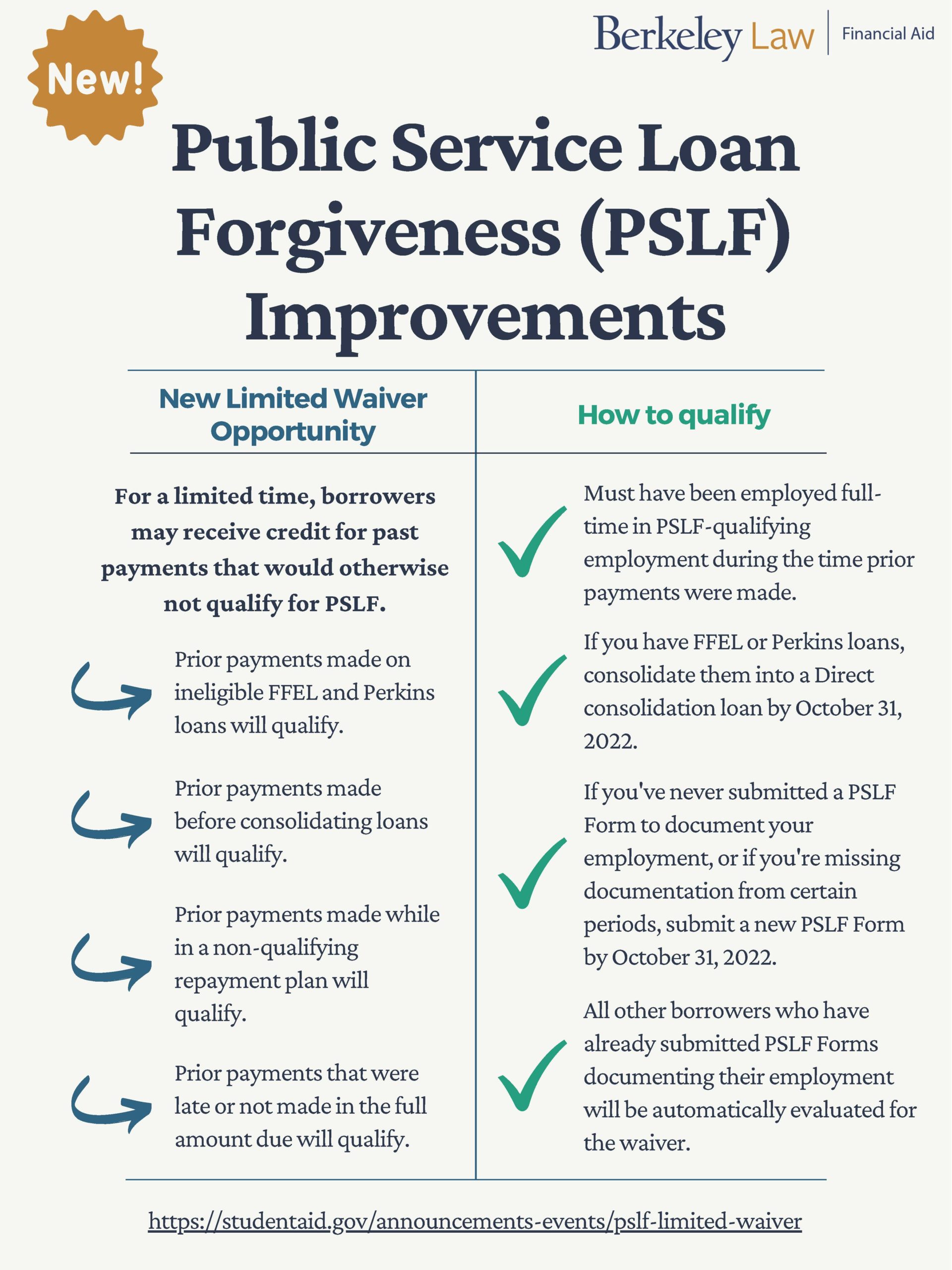

Updated Idr Waiver Summary With Faq R Pslf

Live In Relationships Social Myths Legal Realities And The Way Forward Scc Blog

News Updates Berkeley Law

Theunlimitedcreative Com Passive Income Digital Business Artist

2

Sc 20201231

Trading Card Retro Style Baseball Card Template Trading Card Template Cards

Presentation Materials

36 Logistics Flyer Templates Free Premium Psd Vector Ai Downloads Flyer Template Business Flyer Templates Flyer

2

2